Blockchain Is Coming to FM and Real Estate

Now is the time for FMs to understand what blockchain is and why it matters.

Information is the new currency. Whether it’s gathered on a spreadsheet, an existing software platform, or a blockchain, it’s the driver for business decisions at every level of the organization. Exploring how emerging technologies like blockchain can improve the way you process information and impact your organization’s performance is an activity that needs to be a top priority. Just how big is the world of emerging technologies and how fast is it moving?

Gartner has identified approximately 2,000 emerging technologies, and is tracking 32 of them through the Gartner Emerging Tech Hype Cycle. This report is focused on identifying and tracking technologies expected to deliver competitive advantage over the next ten years. In their 2016 Board of Directors survey, 36 percent viewed blockchain/digital ledger technology as an opportunity; 21 percent viewed it as a threat. Fear of the unknown is often viewed as threatening, and a prime reason for you to start educating yourself on these technologies. You should expect to be invited soon to a meeting to discuss the implications of blockchain for your organization and the industry if you haven’t already – is your organization prepared? Lagging behind in building your understanding of these technologies is dangerous to your future and the enterprise, so let’s start with blockchain.

What Is Blockchain?

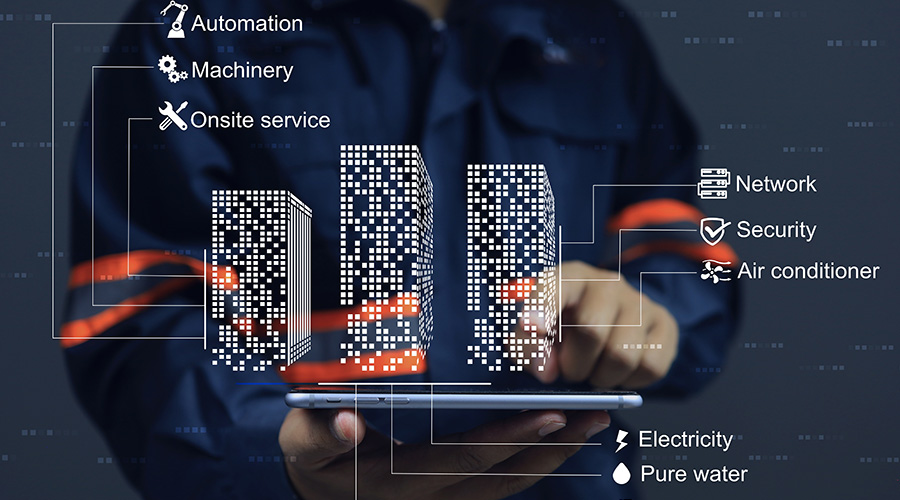

Blockchain is a cloud-based, permanent, distributed digital ledger of activities between parties. Let’s break it down. Cloud-based means it doesn’t sit on your company’s private server, or any other company’s private server. The permanence of this ledger means it lives as a permanent record of activities between parties. These activities can include recording property transfers, asset digitization, HVAC system activities, occupancy of cubicles, or security access. Over time, this historical perspective can enable you to improve your decision-making, make decisions faster, and be shared with other emerging technologies, like artificial intelligence. The distributed digital ledger means it’s distributed among a group of participants. This can be a large group, like a public blockchain that holds records of real property transfers accessible by anyone (think public records), or a private blockchain shared between a client and its service provider, software developer, a consultancy, or a benchmarking firm. Information can also be shared internally, between human resources and IT, for example in one location or globally. Changes to the blockchain occur in real time and in plain view of all participants, improving transparency and security. Applications include smart contracts, cryptocurrency (such as Bitcoin) that can accomplish financial transactions in mere seconds, and many more.

Other Industries Using Blockchain

A separate Gartner report, published in March 2017, estimated that by 2025 (just 8 years from now), the business value added by blockchain will grow to slightly over $176 billion, then surge to exceed $3.1 trillion by 2030. That’s extraordinary growth for an emerging technology that hasn’t yet received widespread notice in the real estate industry. In August of last year, The World Economic Forum estimated that about 80 percent of top global banks will have launched blockchain projects by 2017, describing the technology as the future “beating heart” of the financial sector.

The financial services industry likes the security and other features of the technology, and some have already heavily invested in it. One large financial institution has more than 35 patents either approved or pending based on this emerging technology. Another has more than 40 active blockchain projects in development across the enterprise.

Regulators are looking at the technology with interest, and a Blockchain Innovation Center opened in September, 2016 in Washington, D.C. as a joint venture between the Chamber of Digital Commerce and Technology Incubator 1776. The center is focused on fintech applications, aiding regulators and governmental agencies at all levels to understand the benefits of the technology and address issues including asset registry, cybersecurity, and identity management.

Banks are proactively engaged in building a blockchain-inspired platform, and are driving an international initiative through the R3 Consortium’s Corda Project. This commercial venture includes more than 70 of the largest financial institutions globally with the heaviest concentration of members from North America. They have successfully built the base of a tech stack to address the buy/sell side of investments, with more to follow.

The blockchain insurance initiative, B3i, has developed a blockchain smart contract internally described as “Codex 1” as reported by CoinDesk. The prototype is designed to automate many of the processes involved in catastrophe reinsurance currently fulfilled by brokers, and eventually to improve the trading of risk more broadly. How does it work? In part, the prototype does this by giving the insurance companies seeking reinsurance and brokers and the reinsurance companies that serve them, access to the shared distributed ledger that’s cryptographically secure. The efforts of the fintech and insurance consortiums demonstrate they have firmly planted stakes in the ground to identify ways to monetize this new technology.

Given how closely the real estate industry engages with these sectors, should real estate be lagging so far behind with a “let’s wait and see what happens” approach to blockchain?

Getting Started: “Single Source of Truth” Approach to Data

To harness blockchain and other emerging technologies, the starting point is a hard look at how your organization manages its data. Blockchain is based on a single source of truth, and mandates a standardized approach to the collection and distribution of information that populates the ledger and drives decision making. Are you prepared? If the data driving your organization is collected on multiple platforms that don’t communicate, and the managers of those platforms don’t communicate, you’ve got some serious work to do. Where should you start? A single source of truth approach starts with consistency in terms and definitions. It’s a critical first step to collecting and sharing data that drives your organization to prepare for this new technology and will no doubt change the way business is conducted globally. Blockchain and other emerging technologies will put increasing pressure to break down siloes common in many organizations.

Standards are critical to building an effective data governance process, which must be in place to implement emerging technologies at every level of your organization. It’s not too late to get started. The accelerated pace of blockchain projects in other industries does put pressure on facilities managers and others in the industry to move forward on identifying relevant use cases, proof of concept models, and pilot projects. There are lessons to be learned from the collaboration exhibited in the fintech and insurance worlds. It’s enabled them to move swiftly through identifying use cases, completing pilot projects and moving to the implementation phase in months, not years. They have taken a collaborative and proactive stance to reduce the threat of marginalization. The stakes are high. Will facility management and the rest of the real estate industry do the same?

Lisa Stanley is CEO of OSCRE International, a member-based organization focused on transforming the way digital information drives your real estate business. For more information about OSCRE’s Blockchain Initiative and Data Governance Program, email info@oscre.org, or visit www.oscre.org.

Related Topics: