Danfoss, a leading manufacturer of high-efficiency electronic and mechanical components and controls for air-conditioning, heating, refrigeration, industrial, and water systems, recently conducted an online survey to gauge industry acceptance of CO2 refrigeration systems in North America.

Intended to serve as an industry indicator, the survey collected input from commercial and industrial refrigeration OEMs, consultants, contractors, and end users.

CO2 in commercial refrigeration

According to the survey, the commercial refrigeration industry continues to see CO2 as a viable mainstream technology for refrigeration (82 percent of OEMs; 91 percent of consultants and end users), and about half of OEMs responding see CO2 refrigeration as being at least 16 percent of their business within the next five years. In a similar study conducted in 2012, less than 20 percent of OEMs saw CO2 comprising at least 16 percent of their business.

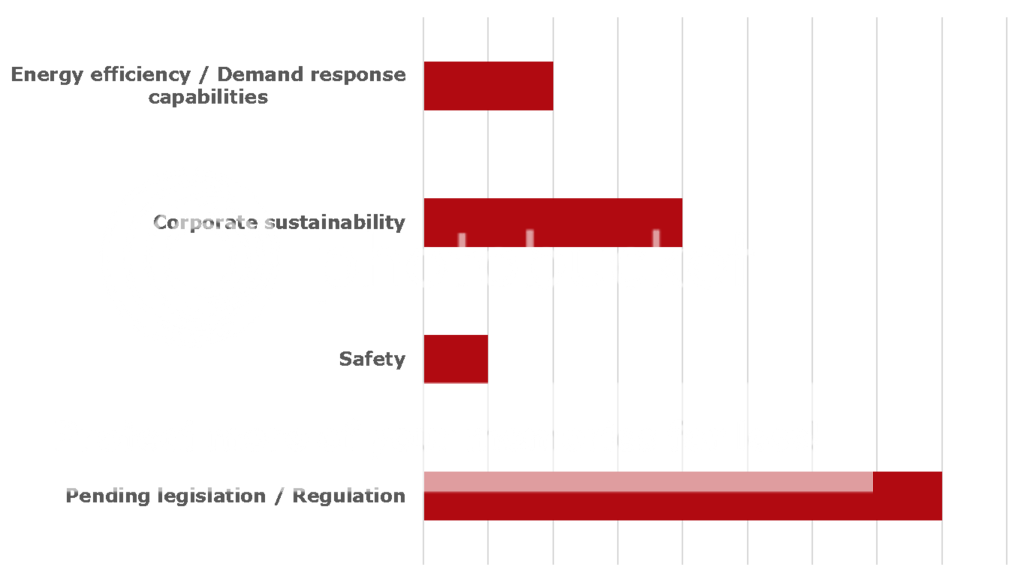

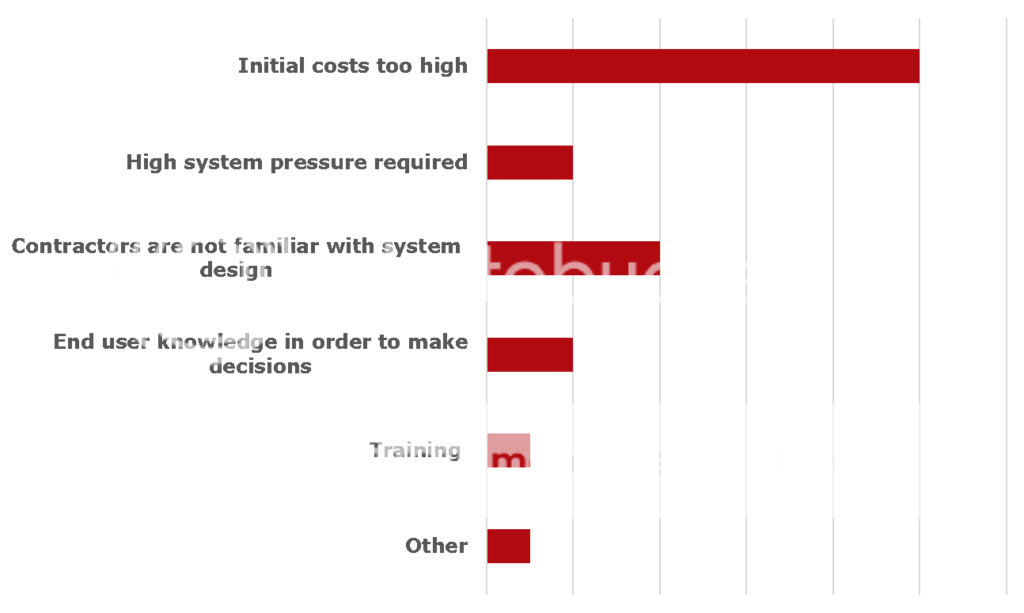

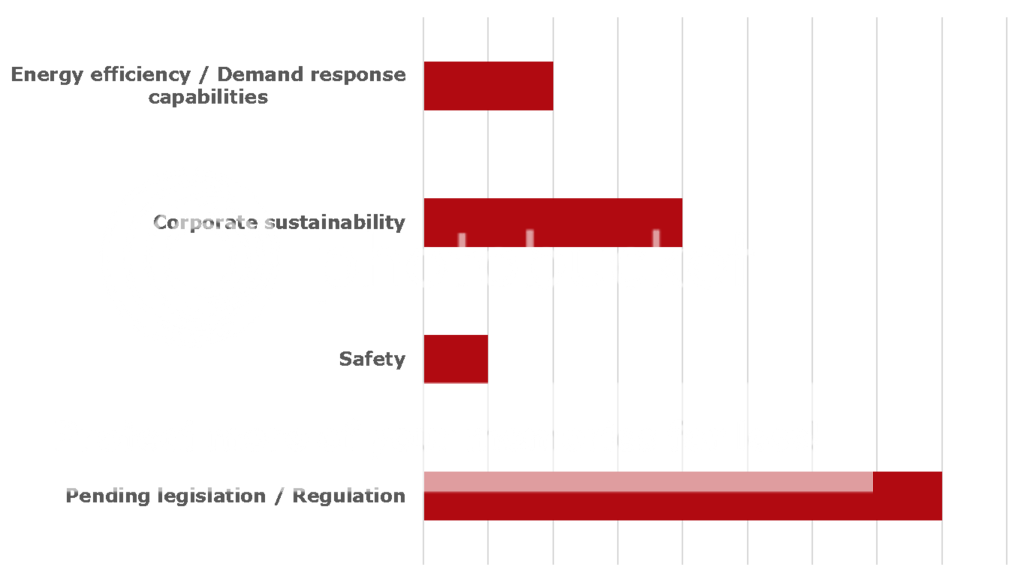

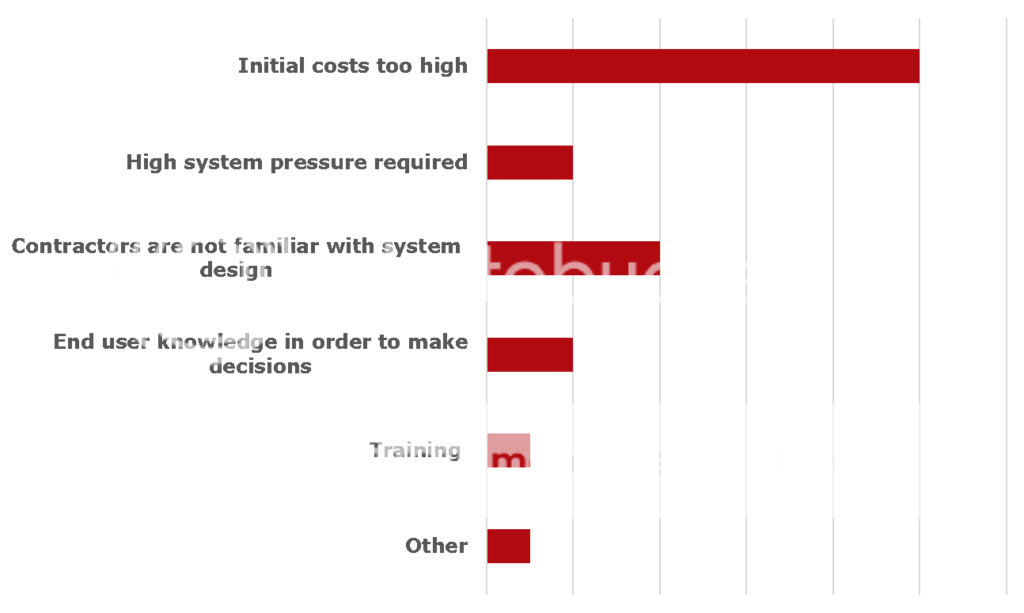

The majority of commercial refrigeration consultants and end users are today engaged in CO2projects, citing pending legislation/regulations and corporate sustainability goals are key drivers in the decision to use CO2. However, at the same time, they identified the high initial system cost as a primary barrier to deployment.

Drivers of CO2 in Commercial Refrigeration

Barriers to CO2 in Commercial Refrigeration

“The results of this survey validate the ongoing growth we are seeing in CO2 projects across North America,” said Peter Dee, sales and services director – food retail, Danfoss. “Globally, Danfoss has been involved in more than 10,000 CO2 refrigeration projects, and we are using this experience to continue investing in technologies like our new CTM Multi-Ejectors that help to minimize the challenges and application barriers to CO2. We have also recently launched our CO2 Mobile Training Unit to address the critical need for training.”

CO2 in industrial refrigeration

The survey also identified similar acceptance in the industrial refrigeration market. Fifty-seven percent of responding OEMs and contractors and forty-three percent of consultants and end users indicated they have already either been involved in a CO2 refrigeration project or have plans to be. However, OEMs and contractors do not see CO2 becoming a significant part of their business in the near future.

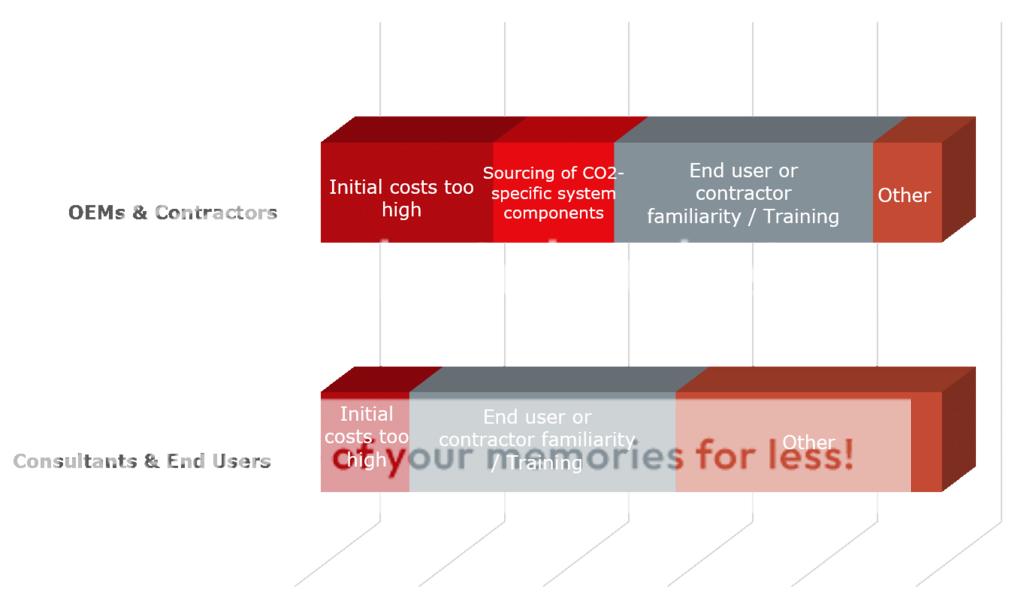

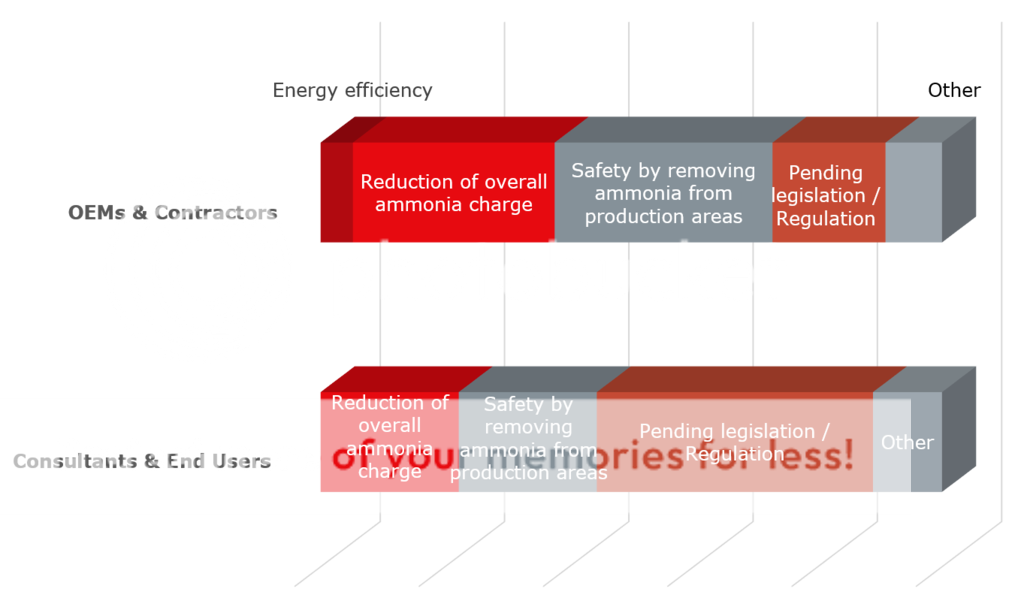

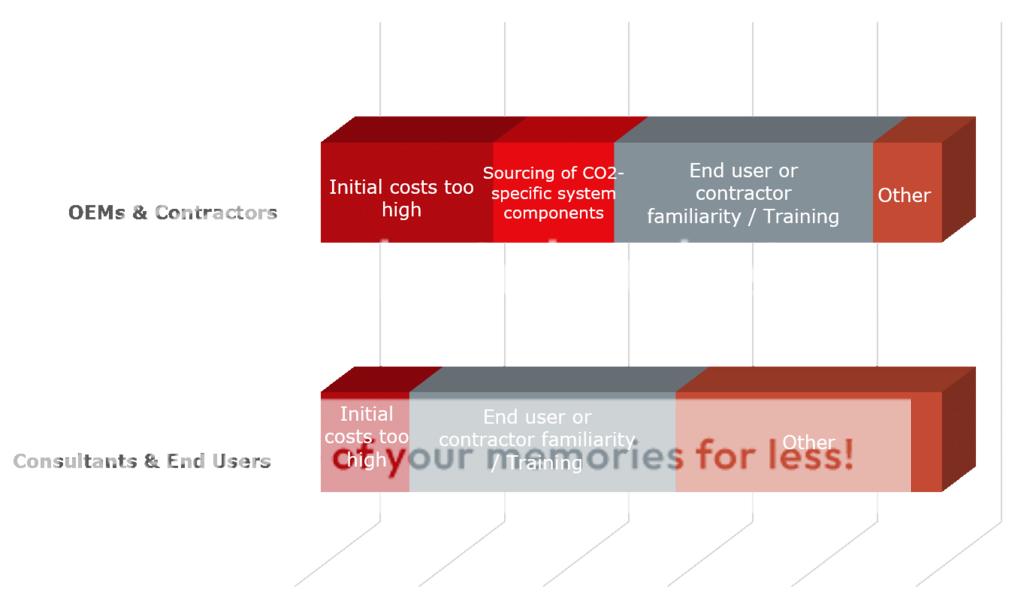

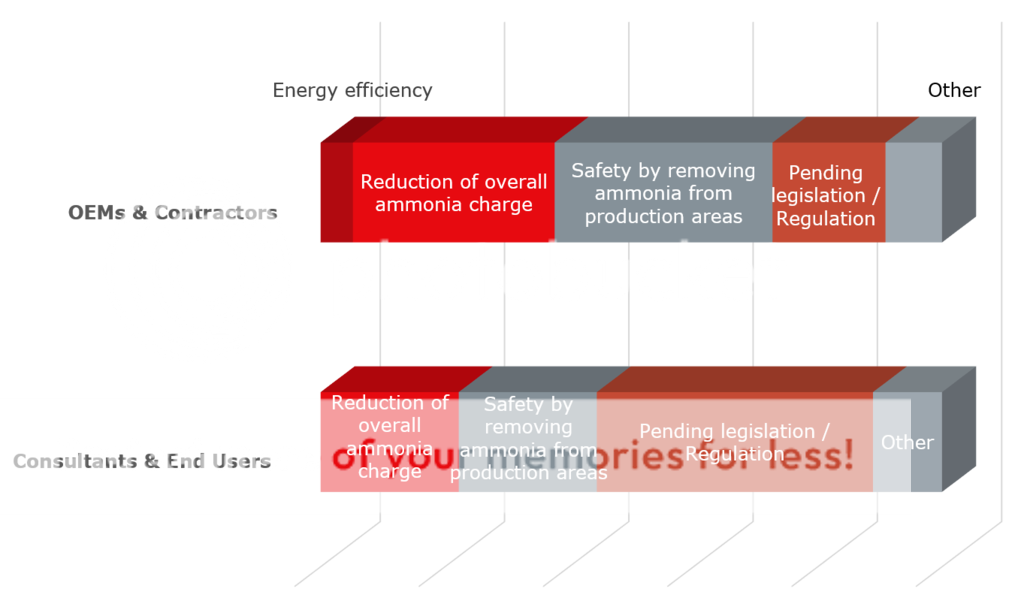

OEMs and contractors identified the removal of ammonia, in terms of improved safety and reduced ammonia charge, as key drivers in using CO2. Consultants and end users agreed, but also cited pending legislation/regulation as important factors. In contrast to the commercial refrigeration industry, industrial refrigeration respondents said the primary barrier to further CO2use is the result of end user and contractor familiarity and training.

Drivers of CO2 in Industrial Refrigeration

Barriers to CO2 in Industrial Refrigeration

This industry indicator on CO2 was conducted as a follow up to a similar survey conducted by Danfoss in 2012 to gauge the market acceptance of CO2 refrigeration. The survey was distributed via email to approximately 1,100 people that do business in commercial or industrial refrigeration applications.