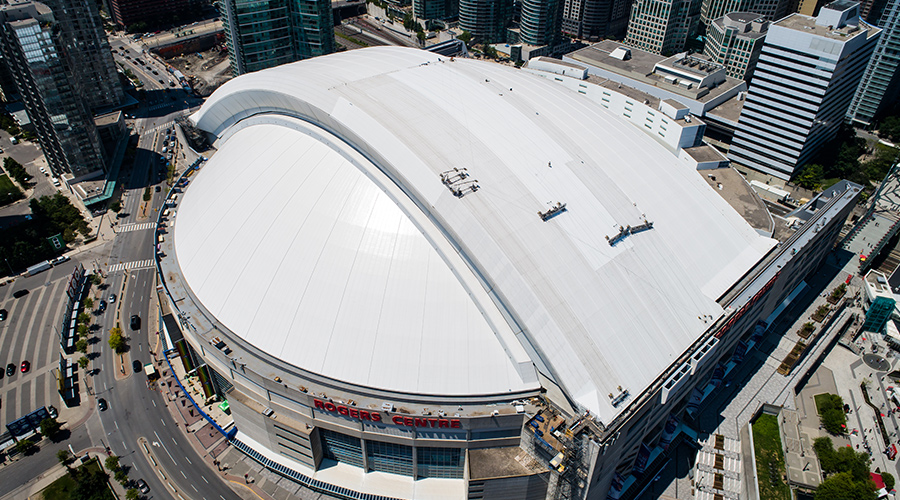

Due Diligence Can Help Ensure Roofing Contractor Is The Right Choice

Have your favored choices fill out a Contractor Qualification Statement such as the American Institute of Architects document number A305. This document will give you information on the contractor's bonding limits, insurance, and financial stability, plus the history of the company. If the bonding rate is more than 2.5 percent, it means that the contractor has had several problem jobs where the surety had to become involved. The bonding limits give you a good snapshot of the size of the projects the firm can handle. If there is no bonding available, it either means that the insurers won't bond them (bad) or that they are too young a company to have a history upon which the surety can base a bonding limit or rate (neutral). Financial stability, creditworthiness and credit references on the form will tell you if the contractor has the financial resources to complete the project. For example, low credit ratings mean that the contractor cannot purchase materials they need unless they receive a large upfront cash payment. That can lead to a situation where the contractor uses the payment from your project to complete a previous project, and winds up without funds to do your roof.

Be careful about looking at the length of time the contractor has been in business. Be sure you ask how long the firm has been in business under the same name. Roofing contracting firms fail nearly as often as restaurants. Unfortunately, there is nothing to stop a person from dissolving the old corporation after the failure and opening up a new one with a new name. If someone shows a pattern of such activity, beware.

A preferred contractor will have been in business with no interruptions or name changes for at least five years, but that is not to say that a new company may not be reliable. It mostly depends on why the company is new. Looking into the background of a new company owner may show many years of solid, stable experience at other local firms. With that kind of background and good credit ratings, this firm may be one to consider, even though it is new.

Look at the firm's history of litigation. If the lawsuits were for non-performance or shoddy performance, steer clear. Unfortunately, companies sue and get sued for many other reasons, which may or may not be relevant to the qualifications as a contractor, so do not use the number of lawsuits as a basis for qualification but rather the reasons for them. One suit 10 years ago and a clean record since is not as much of a concern as a suit last year.

Related Topics: