Understanding the Big Shifts in Power Pricing

First of a 4-part article on utility costs and what drives them

The landscape of power pricing is experiencing near-tectonic shifts. Facility managers should understand what is behind those trends — including wholesale power factors, what creates meter prices, actions of regulators, and natural gas markets — and how those changes are affecting electric rates.

The largest drivers are changes in wholesale energy markets and utility rate regulations. While each may act independently, each also feeds off the other, creating secondary impacts on electric bills.

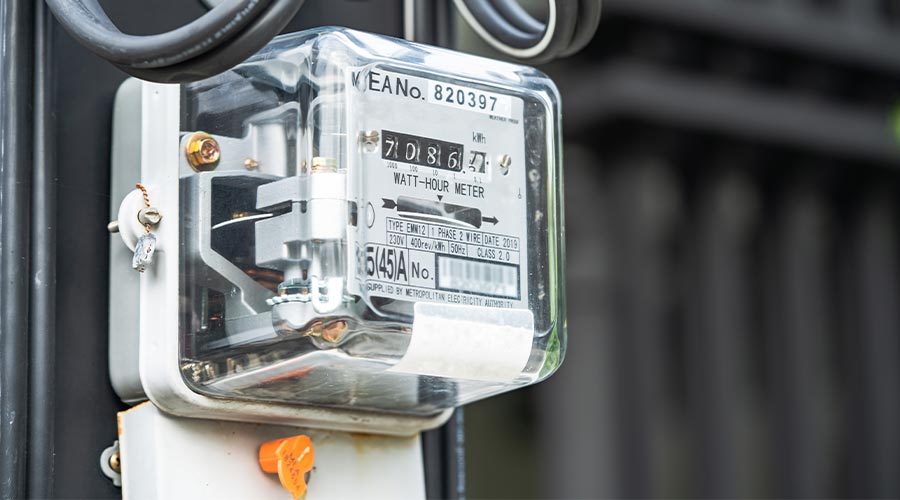

To grasp how these changes may affect a facility’s energy cost, start by understanding that the price paid for power at the meter is made up of many components. Most fit under the general categories of supply and delivery. Supply is, in turn, composed of energy (i.e., the fuels used to make the power) and capacity (i.e., the generation systems that consume the fuel). While many utilities still generate their own power, almost all transmit and distribute (i.e., deliver) power to customers, regardless of its source.

Since 1992, when the federal government opened up power grids to non-utility power suppliers, an increasing amount of the electricity generated in the U.S. has come from wholesale power suppliers that sell to utilities, which then re-sell that power to end users. The wholesale power market operates much like the stock market, with prices changing by the hour. Utilities smooth out such variations via legal documents that spell out details for electric rates called tariffs. These are regulated by state, regional, or municipal governmental bodies called Public Utility Commissions, or PUCs.

Wholesale power pricing varies with the wholesale price of generator fuels, such as natural gas. In many states (excluding Texas), such pricing may also be influenced by seasonal capacity auctions that pay generators to maintain their power plants. Those variations then flow through to customers as part of the cost of their power supply. To cope with occasionally high price spikes, grid operators, regulated by a federal agency, have been raising the cap on peak hourly price offerings from generators, in some cases to several dollars per wholesale kWh. Depending on how customer electric rates are structured, such variations may be handled through monthly or annual fuel adjustment charges (in cents per kWh), occasional changes to overall rates, or changes to peak demand charges (in dollars per kW).

When a PUC mandates changes to the sources of energy supply — requiring supply to come from renewables, for instance — such regulation may impact pricing at the wholesale level. To cover new costs for delivery, PUCs may allow new charges as part of overall ratemaking proceedings, or through interim charges between such events.

Taken together, such continuous changes have led to rate instability.

Related Topics: