Understanding PUC Regulation as a Factor in Utility Rates

Third of a 4-part article on utility costs and what drives them

Another important piece of utility costs is Public Utility Commissions (PUCs), which have wide latitude in how they may distribute costs among customers, and often adjust their rates to do so. They may also be tasked with fulfilling state mandates, such as the proportion of power that comes from renewable sources. Called Renewable Portfolio Standards (RPS), 33 states require some portion of their power to come from wind, hydro, solar, etc. California has taken the lead in this area, with a goal of getting 33 percent of its power from renewables by 2020. Some in that state are pushing to boost that to 50 percent. Most state RPS are around 15 percent or lower.

RPS are also spurring rapid expansion of wind power generation, helping reduce its price. In some states, that falling price is making wind a significant contributor to overall power production. One Texas utility recently signed a long-term contract for wind power whose price was lower than that from fossil-fueled plants. Because of wind’s intermittent nature, hourly wholesale power pricing in some areas has occasionally been driven very low (sometimes to near zero) on windy days. To meet RPS, however, wind power may sometimes be chosen over other sources even when more expensive. Such volatility may then show up in monthly electric bills as positive or negative fuel adjustment charges, leaving customers scratching their heads over why their average rates are fluctuating.

Some state PUCs have also mandated Energy Efficiency Portfolio Standards (EEPS) or other programs that press for reduction in energy use. To meet that standard, incentives are offered to customers and energy service companies, paid out of additions to electric rates.

The extra costs from such standards are collected as $/kWh charges on electric bills, thus hitting large consumers like data centers, industrials, and 24/7 facilities like hospitals harder than office buildings or other facilities using fewer kWh but having comparable peak kW demands.

To reach such goals, some states also offer incentives to install solar panels and other equipment that reduces the need for power production by utilities. A few offer feed-in tariffs (or other payments) that offer high $/kWh prices for the renewable power those systems feed into utility distribution systems. Such extra costs are also recouped via electric rates.

The end result may alter the balance between utility variable and fixed costs, leading to increased demand charges to make up for lost kWh sales.

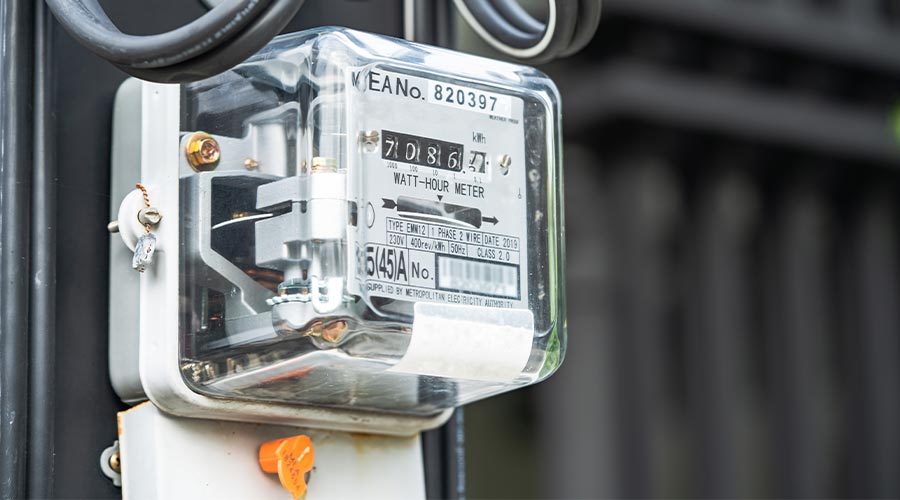

To cope with such challenges, some utilities are transferring their price risk to customers by pushing them onto "dynamic" rates that vary with time-of-use (TOU) or the hourly real-time pricing (RTP) seen at a wholesale power market. Helping them in that effort is the deployment of smart meters that automatically communicate usage in 15-minute intervals. Nearly a third of all electric meters in the U.S. now have that capability, though many have not yet been enabled to do so.

Promoted as cutting metering and billing costs, and to more fairly distribute utility costs based on customer usage patterns, installation of such meters has been followed by offerings — or directives –— to switch customers to dynamic rates. After enabling its new smart meters, Baltimore Gas & Electric tried to make TOU rates mandatory for many customers. The ensuing outcry caused the utility to dial back that effort and make TOU optional.

In states where electricity has been deregulated, PUCs have allowed utilities with smart meters to gradually lower the peak kW threshold below which the supply part of a bill would be charged under a RTP rate. Some now require that even medium-sized customers — those with annual peak demands of 250-500 kW — either pay RTP or buy their power from a non-utility supplier. While many customers in such states have already switched suppliers, others have not, or have switched back to utility supply service without realizing this change had occurred. Based on comments heard by energy consultants serving those customers, the resulting electric bills were not a pleasant surprise.

Related Topics: