Vested Approach to Outsourcing Creates Long-Term Value

Part 1 of a 2-part article explaining how and why the Vested approach to outsourcing is win-win for FMs and providers.

When it is done right, an outsourcing business strategy creates a value-laden win-win relationship between a company and its service provider that is purpose-built to create long-term value for the parties. The key — and the rub — is doing outsourcing right.

More than 10 years of research have gone into identifying how and why some of the world’s most successful strategic outsourcing partnerships — including those at Procter & Gamble, McDonald’s and Microsoft — performed so well. Why were these outsourcing relationships so successful when others (even with the same suppliers) failed?

What emerged from the research and field work was the Vested Outsourcing (“Vested” for short) business model, which is based on five rules and 10 contractual “elements” designed to spur collaborative and innovative mindsets. Today, the Vested business model is catching on, with companies like TD Bank and Novartis shifting to a Vested model in their quest to be more strategic with their facilities management outsourcing agreements. Facilities management experts in the government sector are also beginning to explore Vested, with the Canadian government just releasing a case study on their pilot for environmental services for their Vancouver Coastal Health hospital system.

In a Vested agreement, a buyer and service provider craft a win-win contract wherein the service provider’s success is directly tied to its ability to drive success for the client. Ergo the name: The parties are vested in each other’s success.

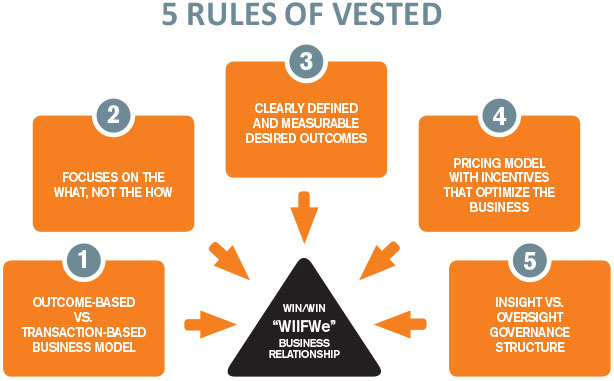

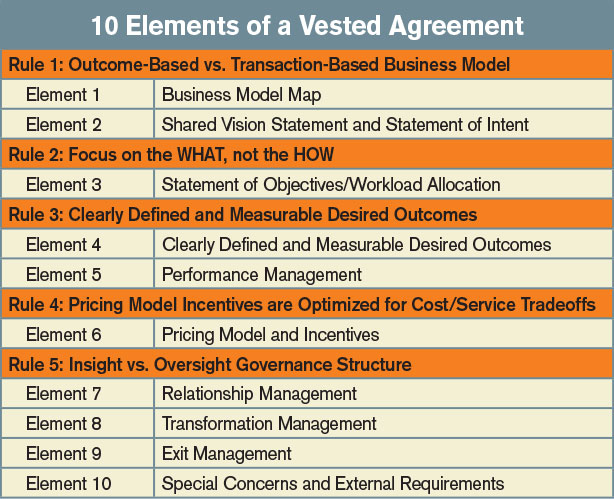

The business model is centered on five rules that, when followed, are designed to enable a buyer and service provider to create a true win-win contract that aligns how the parties will work across 10 essential contractual elements.

Rule 1: Focus on outcomes, not transactions. Shift the mindset from a focus on specific transactions to desired outcomes. Instead of buying transactions, buy outcomes, which can include targets for availability, reliability, revenue generation, employee or customer satisfaction, and the like.

Rule 2: Focus on the “what,” not the “how.” If a partnership is truly outcome-based, it can no longer have a multiplicity of service level agreements (SLAs) that the buyer is micromanaging. The outsourced service provider has won the contract because it has the expertise the buyer lacks. Therefore, the buyer must trust the supplier to solve problems.

Rule 3: Agree on clearly defined and measurable outcomes. Make sure everyone is clear and on the same page about their desired outcomes. Ideally, use no more than about five high-level metrics. All parties need to collaboratively spend time to establish explicit definitions for how relationship success is measured.

Rule 4: Pricing model incentives that optimize the business. Vested does not guarantee higher profits for service providers; they are taking a calculated risk. But it does provide them with the tools, autonomy, and authority to make strategic investments in processes that can generate a greater ROI and value over time, perhaps more than a conventional cost-plus or fixed-price contract might produce over the same period.

Rule 5: Governance structure should provide insight, not merely oversight. A flexible and credible governance framework enables all the rules to work in sync. The structure governing an outsourcing agreement or business relationship should instill transparency and trust about how operations are developing and improving.

The rules work in conjunction with the 10 elements to create strategic outsourcing arrangements that take the parties away from the traditional buy-sell, “what’s in it for me” sourcing business model to a highly collaborative “what’s in it for we” (WIIFWe) model where the parties’ mindsets, economics, and governance structures are aligned.

A key part of the methodology is for a buyer and service provider to work together to craft their physical contract around each of the elements.

The parties work jointly to create and share value for both the buyer and supplier. Embedding and nourishing a WIIFWe mindset creates an environment that fosters sustainable results based on a foundation of value creation and value sharing when the parties drive innovations that benefit the buyer’s business. In essence, the parties architect a long-term “win-win” solution that benefits everyone.

This is not mere theorizing. Two examples show that the model can create transformational value for organizations that apply it for outsourced facilities management deals.

Related Topics: