Inflation Reduction Act Expands Energy Efficiency Tax Deductions

The hugely popular 179D tax deductions get a makeover under the new law with the potential for huge financial benefits for facility managers. Here’s how to take advantage of the new law.

By Charles R. Goulding and Jacob Goldman, contributing writers

The Inflation Reduction Act (IRA) of 2022 was signed into law on August 16, 2022, after passing votes in Congress. Among the provisions included in this bill is the expansion of the Section 179D tax deduction for building energy efficiency. Thousands of commercial building owners have utilized the 179D tax deduction since its inception in 2005, and this expansion potentially allows for many more to not only utilize the deduction but also claim larger amounts than previously available.

Under the Energy Policy Act (EPAct) of 2005, Section 179D allows for energy efficient investments in new and existing buildings to qualify for immediate tax deductions up to $1.88 per square foot through the 2022 tax year. Eligible projects include those related to interior lighting, HVAC, and building envelope. The 179D deduction was made permanent as part of the Consolidated Appropriations Act of 2021.

Owners of commercial buildings can utilize the 179D deduction for building projects completed since January 1, 2006. Owners in all major building categories are utilizing the deduction, including warehouse, industrial, retail, office, hospitality, and restaurant chains.

2023 Updates to Section 179D

The Inflation Reduction Act of 2022 includes numerous updates to the 179D deduction, which take effect on January 1, 2023. Notable updates include:

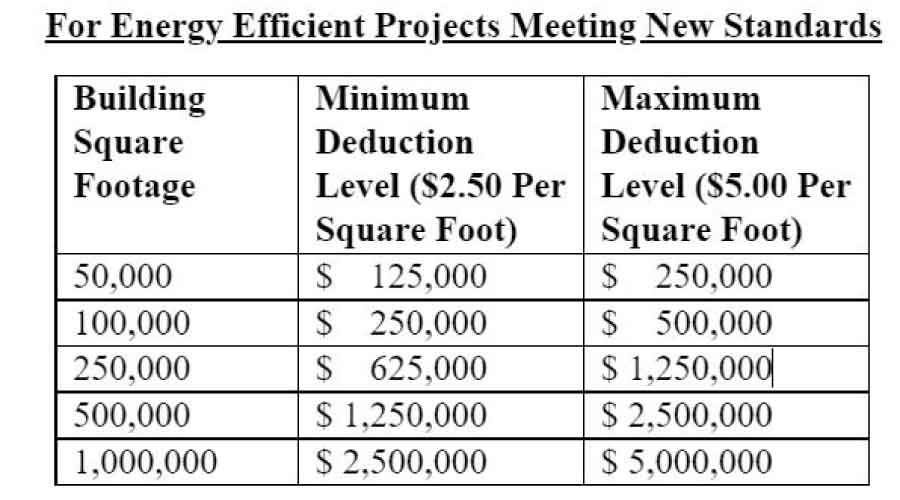

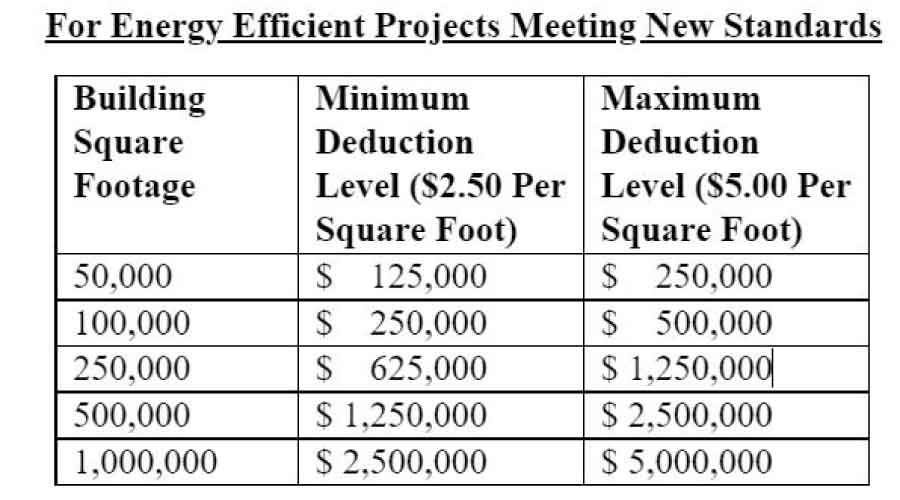

- Deduction levels up to $5.00 per square foot – the qualified deduction range for projects meeting prevailing wage and apprenticeship standards will be between $2.50 and $5.00 per square foot, depending on the building’s energy efficiency level. For projects that do not meet prevailing wage and apprenticeship standards, the deduction level range will be between $0.50 and $1.00 per square foot.

- Inclusion of not-for-profits, instrumentalities and Tribal Government buildings – Designers of energy systems in these buildings are now allowed to claim the 179D deduction for qualifying projects.

- Deduction reset – currently, the maximum 179D deduction can be taken once over the life of the building. With the passage of this new law, the maximum deduction would now be available every three years on a commercial building and every four years on a government, instrumentality, not-for-profit, or Tribal Government building.

New Distribution Centers

With the growth of e-commerce, many new distribution centers have been built in the United States. This is an excellent category for large EPAct tax deductions which are based on square footage. Under the IRA a 1 million-square-foot distribution center could qualify for a $5 million tax deduction.

With warehouse lighting projects, facility managers are required to understand which items are picked more frequently. One strategy is to use sensor-controlled digital fixtures and organize the aisles so that the most frequently picked items are all in the same aisles with the easiest access. With this technique, large portions of the warehouse can be kept dark, meaning virtually no lighting-related electric costs are incurred.

Optimal HVAC system design is critical for worker comfort and productivity. To achieve these results, HVAC systems need to be modeled using building software that takes into account the type of building, geographic location, and the building envelope, including the fenestration and the amount of insulation. Lighting controls, HVAC controls, and other building controls can further enhance the performance of a properly designed building.

Such developments can qualify for EPAct 179D deductions.

179D Benefits Now Available to Nonprofit Hospitals

Another category of commercial buildings is hospitals. For the first time effective January 1, 2023, all hospitals can generate 179D tax benefits. For-profit hospitals and government hospitals (for designers) have also been eligible for 179D tax benefits. Now, the largest hospital category, tax exempt hospitals, can generate 179D designer benefits.

Integrating the New 179D Benefits with Cost Segregation

With new warehouse projects a cost segregation study should be performed to maximize short life tax depreciable assets eligible for faster depreciation, typically at the 5-year, 7-year and 15-year useful lives. Additionally, alternative energy assets are typically eligible for 5-year depreciation. 179D eligible assets are eligible for immediate write off. With buildings, such as warehouses and industrial buildings, the 179D immediate write-off will materially augment first-year depreciation from the cost segregation study.

Alternative Energy Projects

With respect to the other aspects of the IRA, commercial buildings utilizing alternative energy sources can receive substantial tax savings. In addition to traditional alternative energy projects like solar qualifying for substantial tax credits, big winners include projects installing ground source heat pumps, combined heat and power or thermal storage. These technologies previously had a mere 10 percent credit or no credit at all and now with passage of IRA can achieve 30 percent credits and even a 40 percent credit if the project meets the United States domestic content requirements. Commercial builders that integrate alternative energy sources can use these new tax benefits to further grow their alternative energy business practices.

The IRA allows tax credit recipients to monetize the credits in two ways: either by a direct pay option or by transferring the credits to another taxpayer.

New distribution centers installing solar can earn alternative energy tax credits plus the large EPAct tax incentives described above.

Conclusion

With the passage of the Inflation Reduction Act, companies are now positioned to monetize the 179D deduction in a greater capacity than ever before. The increased deduction levels lead to a quicker payback and improved return-on-investment (ROI) for distribution center owners who are considering installing energy efficient equipment. For designers, the deduction can now be used on energy efficient designs for non-profit, instrumentality and Tribal government buildings. The increase in potential tax savings allows companies to fuel further energy efficient upgrades and improvements.

Charles R. Goulding, Attorney/CPA/MBA, is the President of Energy Tax Savers. The firm includes engineers in various disciplines and focuses on industries such as architecture and engineering (A&E), construction, lighting, HVAC, and more.

Jacob Goldman LEED AP, is the VP and Chief Engineer of Energy Tax Savers and is a chemical engineer with an MBA. Goldman has presented EPAct 179D tax deductions at various speaking events such as AEE East, West & World, and many more.

Related Topics: