When Two Companies Become One

Corporate mergers and acquisitions are a little like arranged marriages. Here’s how some facility executives weathered the ups and downs

By Greg Zimmerman, Executive Editor

During a corporate merger or acquisition, the mood of employees in the companies involved usually swings one of two ways. Sometimes employees are excited about the prospect of working for a larger, stronger post-merger company. More often, though, they become tightly wound balls of stress, constantly wondering whether their jobs will still exist tomorrow.

Facility executives are just as susceptible to this stress as everyone else, maybe even more so. They have the same primary M&A responsibility as executives in other corporate business units — working with their counterparts at the other company to bring together two departments, which means standardizing policies, procedures and systems. But the facility executive also has to branch out to coordinate with other business units to determine whether to consolidate facilities with overlapping functions, and if so, how that should be done and which buildings should be divested. The exact criteria vary, but the process must be handled so that costs are minimized and business continuity is ensured. And all the while, there’s the risk that the facility executive’s own job might end up on the post-merger cutting room floor.

Of course, every merger or acquisition is different, and therefore each requires a different strategy, depending on whether the facility executive works for the company doing the acquiring or the one being acquired. Still, grizzled veterans of the game recognize several ways that facility executives confronted with the head-pounding stress of an M&A can help minimize the pain.

“The first step is to volunteer to be part of any team working on the merger or acquisition,” says Stormy Friday, founder and president of The Friday Group, a facility management consulting firm. “One of the failings of facility professionals is that they wait for someone to come to them. It’s important to be proactive. Try to be on the due diligence team.”

The due diligence or merger planning team is responsible for looking at every aspect of business, from financial data and corporate philosophies to real estate holdings, and then working with the other company’s due diligence team to construct a plan for the transition into the post-merger environment. Larger corporations often have a due diligence team for each business unit, as well as an overall corporate-level team.

View From the Top

For facility executives, securing a spot on the due diligence team at the corporate level should be a priority. That seat will provide a good look at the overall corporate goals of the merger or acquisition. The corporate due diligence team usually consists of representatives from all walks of corporate life, so facility executives can take this big-picture view back to their own due diligence team with a clear set of goals. Corporate real estate decisions will be more in tune with the goals of the merger or acquisition. If the facility executive works for the company being acquired, he or she can help the staff prepare for decisions made by the acquiring company.

When SBC acquired AT&T last year, both companies’ mammoth real estate portfolios, combined with the fact that the two companies were competitors in some locales, forced an extremely bureaucratic due diligence process.

“There were some areas where SBC and AT&T were still competitive, so we still had to behave as competitors until the acquisition was complete,” says Alan Abrahamson, corporate real estate asset manager at the new AT&T, and the real estate operations director at AT&T before the acquisition. “We could only share information that was non-strategic. We felt like two parts of a marriage that were highly chaperoned.”

Essentially, the process involved a series of questions, with SBC, as the acquiring company, doing the asking and AT&T doing the answering.

“The questions were designed so that we could understand the structure of their organization,” says Vickie Berry, assistant vice president of corporate real estate at the old SBC and the new AT&T.

Both questions and answers were scrutinized by lawyers to ensure that the two companies weren’t breaking any federal commerce laws. After answers were sent back and approved by the lawyers the two sides would meet in a “parlor room,” monitored by lawyers, to discuss the answers.

Additionally, there was a separate question-and-answer “clean room” for issues that had to be dealt with but that included sensitive information.

As cumbersome as it was, this process showed Berry how differently the two organizations were structured. For example, AT&T’s corporate real estate organization handled administrative space, but its network organization handled day-to-day maintenance of its network facilities. At SBC, every facilities-related function was handled at the corporate real estate level — a more centralized model.

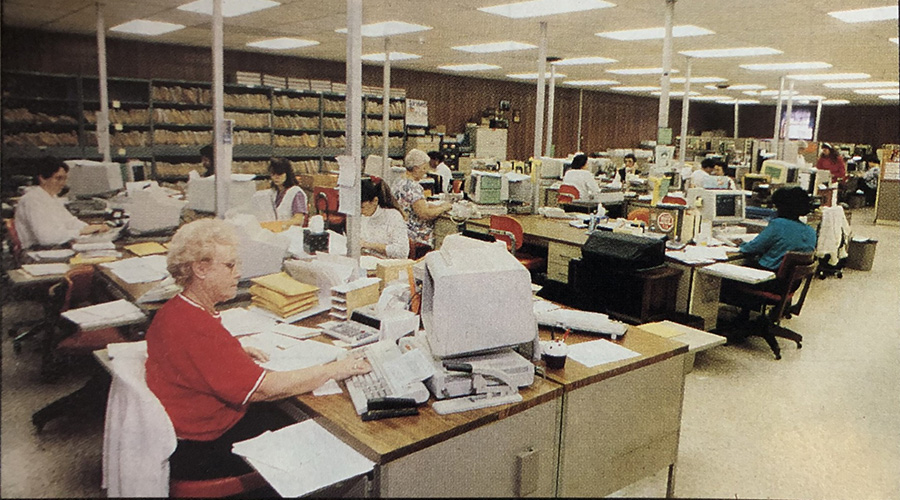

“So ‘corporate real estate’ as SBC defined it was in two separate business units at AT&T,” says Berry. “Plus, AT&T’s corporate real estate handled some functional areas we didn’t consider part of the pure real estate function — mail, for example. So we had to decide how big the new corporate real estate department would be, what it would consist of, where to locate it, how many people we’d need, and what the skill sets of those people would be.”

The teams ended up with a model that Berry says “put corporate real estate back together.” The acquisition was completed late last year, and while Berry and Abrahamson agree that the process worked, both also agree that it took longer than it probably should have, and was rather stressful, mostly for Abrahamson’s side.

Reducing Redundancy

Part of the process was also working on how to dispose of or divest redundant real estate — a major challenge of any merger or acquisition. For most organizations, how real estate is consolidated depends on a number of factors. Chief among them is the type of building and where it is located.

“The criteria for consolidation depend on asset class,” says Tony Zivalich, senior vice president at Trammell Crow. “For instance, if you have two data centers, you ask which is more reliable. The headquarters facility is often where there is the most redundancy and where there’s the most politics. Where does key leadership want to live? Overall, the important thing is to segment facilities by asset class and then by location.”

“Basically, the decision depends on how we can best serve our clients,” says Frank Robinson, vice president of corporate real estate at McKesson. “If we move into an area where we don’t have a share of the market, we’ll keep their facilities. If we already have market penetration, we’ll consolidate.”

For administrative space, the decision often depends on whether a facility is owned or leased, the occupancy rate if owned, and if leased, whether the lease is long- or short-term and whether or not the terms are favorable.

“You have to work with all parties and identify the factors that might make one piece of administrative space more favorable,” says George Lockhart, vice president, group manager, corporate properties group at Wells Fargo. “Is it a better layout? Is there more space for growth? When we acquire a company, it may not always be the Wells Fargo facility that stays.”

Retail facilities require special considerations, says Zivalich. If a merger or acquisition occurs and two or more retail facilities in an area are both successful, one store is just re-branded and business continues as usual. It all depends on what the location and its market can support and what will be most convenient for customers.

For all types of buildings, it’s important that good information exist and be readily available. Having such information — everything from square footage to lease details to environmental reports to energy data — at beck and call not only makes the entire decision process much easier, but also speaks to the credibility of the real estate organization.

“It still happens that the acquired company is the one that takes over corporate real estate,” says Zivalich. “They demonstrate to the leaders of the acquiring company that they have their act together.”

Even if the real estate department of the acquired company doesn’t wind up running the show, the fact that it had solid information can save a lot of work.

When Washington Mutual acquired Providian in 2005, Providian had been near the end of a several-year process of identifying and reducing underused real estate.

“Washington Mutual didn’t have to make many decisions,” says Boris Letuchy, former director of facilities for Providian. “The decisions were already made regarding real estate. We still went through the due diligence process on both sides to make sure our plan dovetailed with their plans.”

Providian became Washington Mutual’s credit card servicing division, so the fact that Providian had a facilities master plan already in place was a key consideration in the acquisition, says Letuchy.

Merging Philosophies

Probably the two highest priorities in a merger or acquisition are developing the structure of the newly formed real estate or facilities department and identifying goals for overlapping buildings. But another important task remains after these steps are completed — identifying and standardizing the systems, policies and procedures of the new real estate organization.

The goal is to compromise, but sometimes that isn’t possible. That’s especially true when it comes to sourcing philosophy.

“One of the most important challenges is determining the impact of the merger on corporate culture,” says Friday. “Most companies don’t spend enough time looking at the cultural implication of a merger or acquisition. That always trickles down to real estate and facility management. Does the company value human capital or is it just a body shop? Is facility management a strategic organization or just an operational arm?”

Letuchy found out the hard way that sometimes the sourcing philosophy is non-negotiable. Providian included facility management as a core competency of its real estate department, so everything was done in-house. When Washington Mutual, a company that outsourced most of those functions, began the acquisition process, Letuchy and many of his staff could see the writing was on the wall.

“We did a certain amount of research into their structure and organization,” he says. “Everyone, facility coordinators to facility managers, knew their jobs were in jeopardy.” Much of the Providian facility staff, including Letuchy — who did have the option of taking a different job, but declined — were let go.

Beyond sourcing philosophy, there are always issues for which the acquiring firm will have the final say and the acquired organization will have to adapt.

“There are certain things that are less desirable to negotiate,” says Robinson. “For instance, one is how our database of current building portfolio information is stored. For other things that represent a financial risk to the company, we want all new business units adhering to our policies.” Robinson, whose company completes three or four acquisitions per year, says some of the non-negotiable issues include strategies for complying with Sarbanes-Oxley and environmental issues. But items like whether employees get 10-by-10-foot or 10-by-20-foot cubicle space are more negotiable, he says.

During the AT&T and SBC acquisition, getting systems to match was a Herculean endeavor — one that continues even now and will for a long time. “We have a combined 190 million square feet,” says Abrahamson. “There are numerous ways of tracking data. It’s a sizable task to get data to match.”

Berry says it’s a task SBC was still working on from its last acquisitions in the late 1990s and early 2000s, and there will be no rest for Berry and Abrahamson as the acquisition of BellSouth/Cingular by AT&T is expected to be completed later this year. This acquisition, pending approval, will bring AT&T’s real estate portfolio to more than a quarter billion square feet.

Don’t Fail To Communicate

One of the more important lessons both Berry and Abrahamson have learned as veterans of several mergers and acquisitions is that facility executives must resist the temptation to get too wrapped up in the hoopla surrounding the merger or acquisition, so that they neglect the core function of the business.

“There were very few people involved in the merger planning,” says Berry. “Top management wanted the employee body to keep the focus on their job — not on the merger. There was real emphasis on staying the course.”

The most important lesson learned, according to all the experts, is the value of good communication throughout the process.

“It’s so important for people on committees and task forces to be cognizant of the stress on the working folks,” says Lockhart — a sentiment echoed by Letuchy, who says that he, along with many Providian employees, found out the company was going to be acquired by watching the evening news.

“They didn’t share all the details and didn’t tell us much,” he says. “After disappearing for a few weeks, they’d come back with a staffing plan, for example. From my point of view, it would have been nice if they had worked a little more closely with us and trusted us a little more.”

Better communication would have allowed Providian to engage more in the process and thus have made the whole process run more smoothly for both sides, Letuchy says, especially because Providian folks didn’t see the acquisition coming. Good communication can allay some of the stress and worry of employees who just don’t know what’s happening.

“In a way, mergers and acquisitions are like arranged marriages,” says Lockhart. “There are times when things are friendly and there are times when things are contentious. The key is finding a way to communicate to make it work.”

Related Topics: