Rocky Mountain Institute's VBECS Metric Helps Calculate Value Of Deep Energy Retrofits

RMI's Retrofit Value Model for Occupants

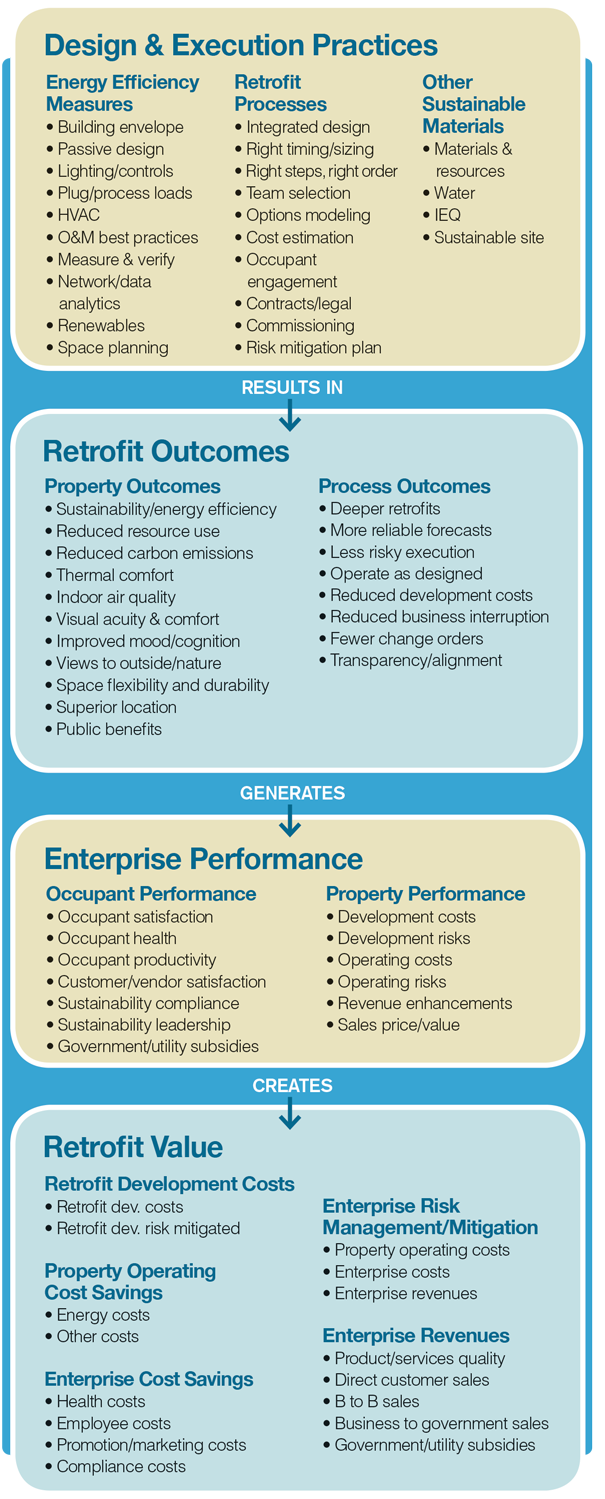

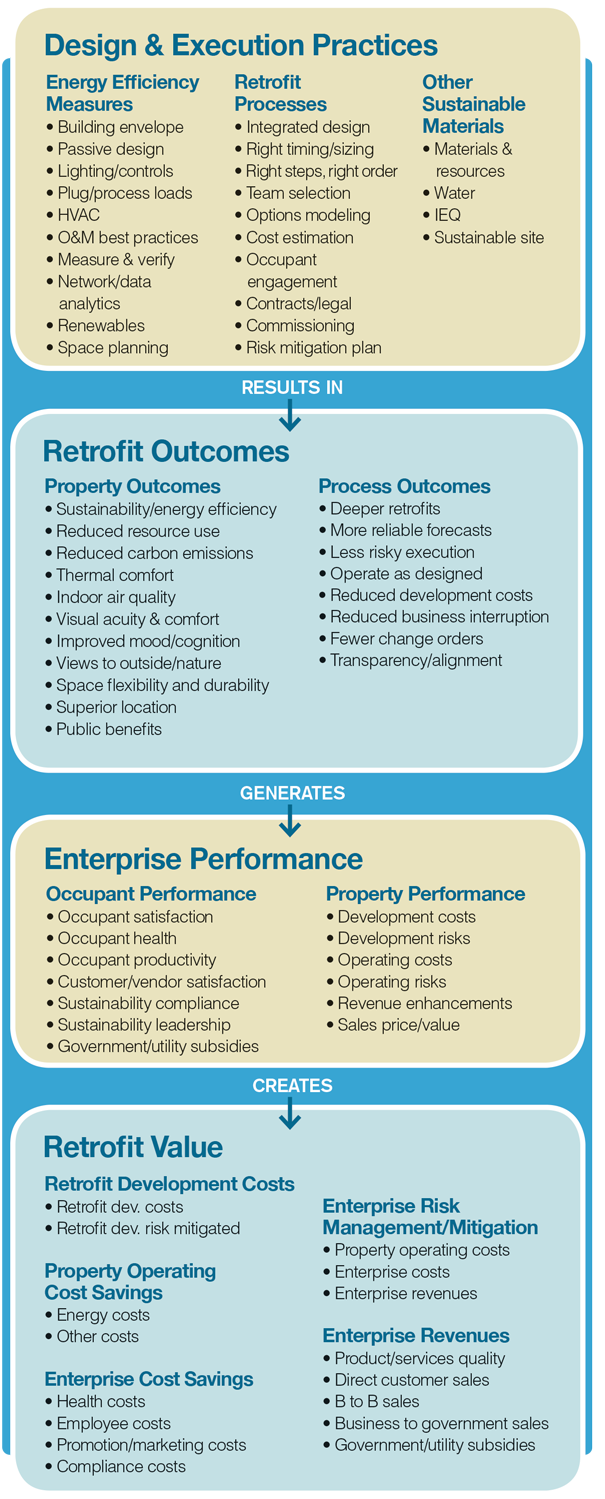

The graphic highlights insights about calculating and presenting retrofit value. It is not surprising that best practices design and execution (top box) is the foundation of retrofit value. What is less understood, and central to calculating and presenting value, is that best practices significantly reduce risk and uncertainty in performance forecasts.

The graphic highlights insights about calculating and presenting retrofit value. It is not surprising that best practices design and execution (top box) is the foundation of retrofit value. What is less understood, and central to calculating and presenting value, is that best practices significantly reduce risk and uncertainty in performance forecasts.

Reduced risk translates directly to value. For example, if you have a long term $1,000 annual net cash flow savings from a seasoned energy retrofit project, you might only require a 4 percent return, which would on a simple cap basis value cash flows at $25,000. However, if you have the same $1,000 cash flow from forecast energy cost savings from a retrofit, you might want a 10 percent return, which would value the same cash at $10,000, a 60 percent value reduction. If capital providers perceive a lot of risk in forecast energy savings, it dramatically reduces the value they recognize from the investment.

This observation highlights the vital role that facility/property managers, sustainability service providers, and product providers can play in calculating and presenting value. Presumably, service providers and facility managers have employed many strategies in design and implementation to ensure high performance and reduce risk. These strategies need to be succinctly but thoroughly documented and included in the presentation to capital providers as shown in the bottom box (Retrofit Value). It is important to present retrofit development costs with proper context, including assessing alternative options, contingency costs, benchmarks and most importantly a structured presentation of risks, both positive and negative, and risk mitigation efforts.

The calculation and presentation of retrofit value for occupants is organized around the 16 value elements that define retrofit value. While every project will not create value in all of the categories, following a structured process is important to make sure you include all value elements and do not double count. One example of the importance of structure is in the evaluation of the value of retrofit-derived reputation and leadership. These are well-recognized benefits in recruiting and retention, customer acquisition and retention, vendor relationships, and risk management. The 16-value-element structure in this case enables facility managers to fully understand and present the value ramifications of reputation across various parts of the enterprise.

Despite improving transparency and standardization of energy measurement and reporting, the great work documenting the energy savings of individual energy efficiency measures, and academic work establishing the link between sustainability and value, there is still a significant gap in practical methods and practices of calculating and presenting the value of sustainability for specific projects. The Rocky Mountain Institute (RMI) has developed a metric called value beyond energy cost savings (VBECS) project to fill this gap. This metric integrates the Green Building Finance Consortium's work in "Value Beyond Cost Savings" with RMI's historic strengths in best practices in building technology, design, and retrofit execution.

Deep Retrofit Value Models

The VBECS project represents a significant advance in the industry due to its focus on deep retrofits, explicit separation of occupant and investor value models, a more direct link between specific energy efficiency measures and value, and a focus on a structured process for calculating and presenting value. Most importantly, the project will provide practical guidance on how to integrate health and productivity, reputation and leadership, and risk reduction benefits of sustainable projects into a financial analysis and retrofit decision.

Perhaps most important is the explicit separation of occupant and investor models. For occupants, the value of the sustainable and energy efficiency retrofit comes from the value contribution to the occupant's organization, and value should be calculated and presented in those terms. Accordingly, it is the value as determined by the cost savings and revenue enhancements for the organization, as well as risk management and mitigation, that matter to occupants. For example, an owner-occupant of a highly efficient building might benefit through reduced energy and operational expenses, more productive staff, and a branding approach including sustainability. For investors, retrofit value comes from the value contribution to the property that is determined by initial development costs, operating costs, revenues, and risk. For both models, the key strength is that they rely upon traditional business and property valuation methodologies that capital providers know and understand, and enable retrofit project sponsors to calculate and present the value of retrofits in language (and numbers) they understand.

Related Topics: