How the Inflation Reduction Act is Accelerating Energy Projects

Updates to 179D tax deductions and the Investment Tax Credit can bring big savings for facility managers.

By Charles R. Goulding and Raymond Kumar, Contributing Writers

Signed into law last August, the Inflation Reduction Act (IRA) of 2022 was a transformative legislation that enhanced energy tax incentives to unprecedented levels. Two such incentives were the Investment Tax Credit for alternative energy and the Section 179D tax deduction for building energy efficiency, both of which stemmed from the Energy Policy Act of 2005. For these incentives, the maximum amounts available have more than doubled and have expanded to include more types of projects to qualify.

Section 179D Overview and Inflation Reduction Act Updates

Section 179D allows for an immediate tax deduction for lighting, HVAC and envelope installations in buildings. In addition to commercial building owners benefitting from 179D, a unique provision of this legislation has historically allowed design firms to monetize the deduction for government building projects. Design firms can include architects, engineers, design and build firms, energy service companies (ESCOs) and systems designers.

The Section 179D deduction was overhauled as part of the Inflation Reduction Act. Notable updates effective January 1, 2023 include:

- Maximum deduction more than doubles to $5.00 per square foot – following the maximum 2022 deduction level of $1.88 per square foot, the maximum deduction in 2023 becomes $5.00 per square foot for projects meeting prevailing wage and apprenticeship requirements. For projects not meeting these requirements, the deduction level range is between $0.50 and $1.00 per square foot.

- Expanded designer benefit – in addition to government building projects, designers are now able to take the 179D deduction for projects on buildings owned by not-for-profits, instrumentalities, and Tribal Governments.

- Deduction reset – starting in 2023, the maximum 179D deduction can be taken every three years on a commercial building and every four years on a government, instrumentality, not-for-profit or Tribal Government buildings. Prior to 2023, the maximum deduction was allowable only once over the building’s life.

Investment Tax Credit Overview and Inflation Reduction Act Updates

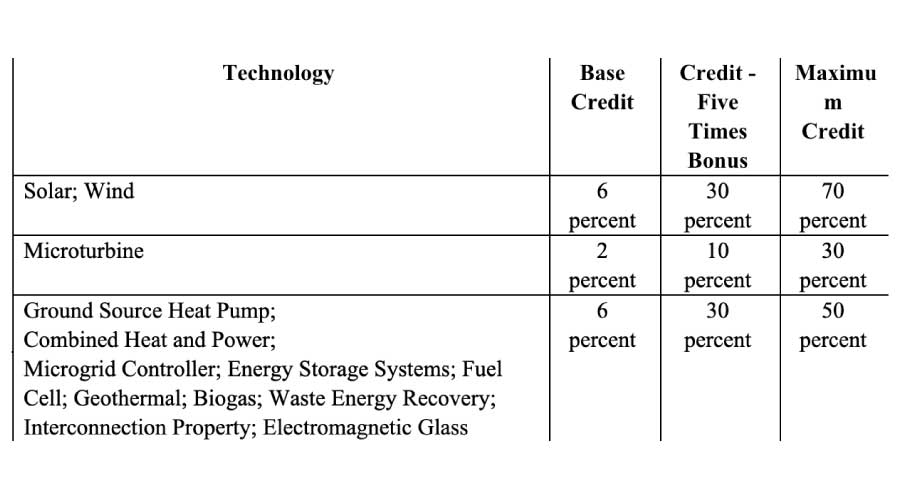

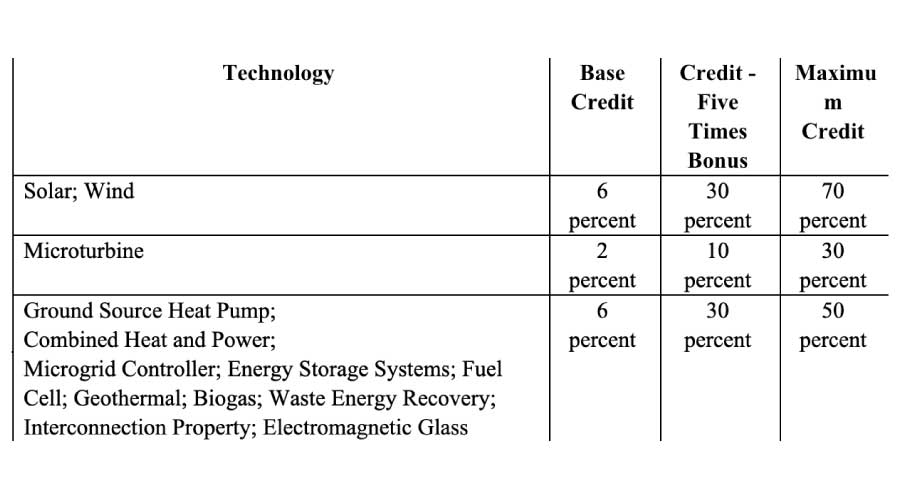

As part of the Investment Tax Credit, firms have been able to receive a percentage of the cost of designated alternative energy installations as a tax credit. Designated alternative energy technologies include solar, geothermal, thermal energy storage and combined heat and power.

The Inflation Reduction Act modifies the credit to a two-tiered system, with additional bonuses for achieving specified criteria. Certain designated technologies have a maximum credit potential of 70 percent, with most having a maximum of 50 percent.

Most eligible technologies start with a base credit tier of 6 percent and can be moved into a ‘five times bonus’ tier if the installation utilizes both prevailing wage rates and apprenticeship workers, or the system is under the net output cap of 1 megawatt (which translates to roughly 284 tons of cooling for the HVAC technologies). With the “five times bonus,” a 6 percent base credit is increased to 30 percent.

The credit level can be increased further with the following criteria:

- 2 percent base credit increase (or 10 percent if meeting the fivefold requirements above) if at least 40 percent of the cost of steel, iron or the total manufactured project is produced in the United States.

- 2 percent base credit increase (or 10 percent if meeting the fivefold requirements above) if in a designated energy community.

- For solar and wind – 10 percent additional credit if installation is located in Indian Tribal land or a designated low-income community, or 20 percent if in a qualified low-income residential building or economic benefit project.

Two notable provisions added by the Inflation Reduction Act relate to the expansion of beneficiaries:

- Section 6417 – allows for certain governments (particularly state, municipal and Indian Tribal) and non-profit entities to directly benefit from alternative energy investments for the first time.

- Section 6418 - allows eligible taxpayers to transfer the credit to other eligible taxpayers. This creates an opportunity for entities in a tax-loss position to benefit by selling their credit to another taxpayer.

Prevailing Wage and Apprenticeship Requirements

A key component of qualifying for the larger incentive levels within both Section 179D and the Investment Tax Credit is the use of prevailing wage and apprenticeship labor for the equipment installations.

Prevailing wage rates can be found at www.sam.gov, and beneficiaries must record labor specific information, including worker names, positions, description of work performed, hours worked, and wage rates paid. For installations started January 29, 2023 and later, a specified percentage (based on construction start date) of total labor hours must come from apprentices to qualify for the higher incentive levels. Additionally, for projects utilizing at least four workers for installation, at least one of them must be an apprenticeship.

Projects with construction starting before January 29, 2023 are exempt from the prevailing wage and apprenticeship requirements (and are able to benefit from the higher incentive levels, regardless of the type of labor utilized).

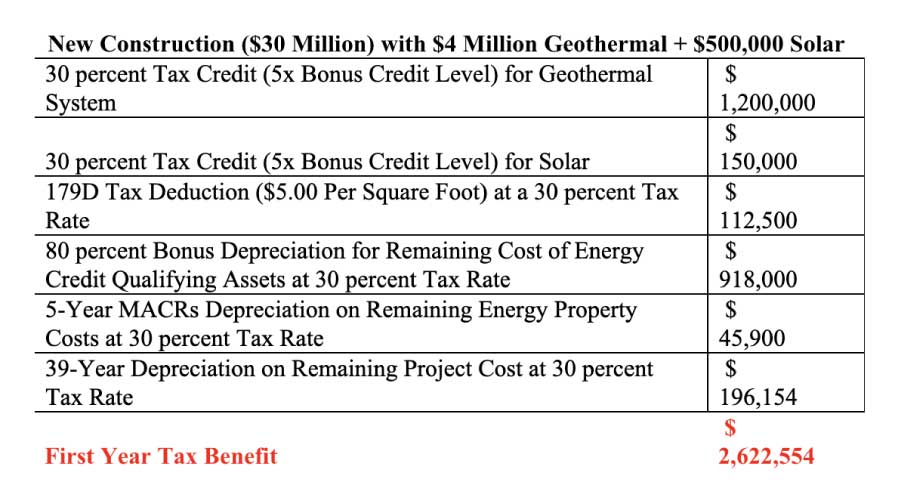

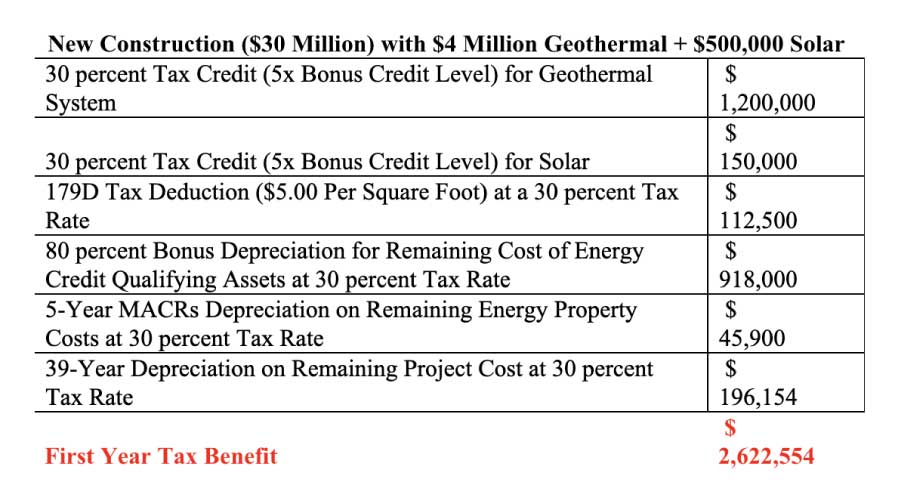

Section 179D and Investment Tax Credit Facility Construction Example

Consider the construction of a 75,000 square foot commercial building at a total cost of $30 million, of which included a $4 million geothermal system and $500,000 solar system. Combining the Section 179D deduction, Investment Tax Credit and other depreciation benefits, more than 50 percent of the energy system’s cost would be a first-year tax benefit in the following example:

Conclusion

With the updated energy tax incentives in effect, companies are now positioned to receive immediate tax benefits in a greater capacity than previously. The Section 179D deduction maximum has more than doubled, and alternative energy tax credits with a maximum of at least 50 percent are now available for many technologies. Additionally, more building types and beneficiaries are covered under these incentives starting in 2023, thus accelerating the potential for energy efficiency adoption.

Charles R. Goulding, Attorney and CPA, is the President of Energy Tax Savers, Inc. The firm includes engineers in various disciplines and focuses on industries such as architecture and engineering (A&E), construction, lighting, HVAC, and more.

Raymond Kumar, CPA is the Manager of Energy Tax Savers, Inc.

Related Topics: