Section 179D Federal EPAct Tax Benefits Extended For Two Years

Tax deductions are again available for qualifying energy efficiency upgrades to commercial buildings

By Charles R. Goulding and Jennifer Reardon

At the end of the 2015, President Obama signed the extension of Section 179D, the Energy Efficient Commercial Building Deduction. 179D was extended for two years, one year retroactive (2015) and one year forward (2016). Section 179D tax incentives of up to $1.80 per square foot are available for qualifying lighting, HVAC, and building envelope projects.

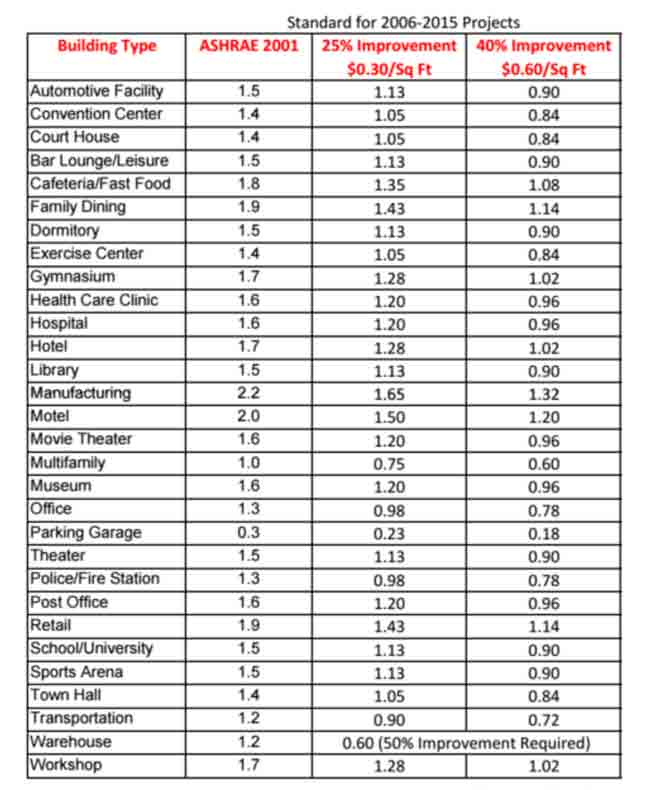

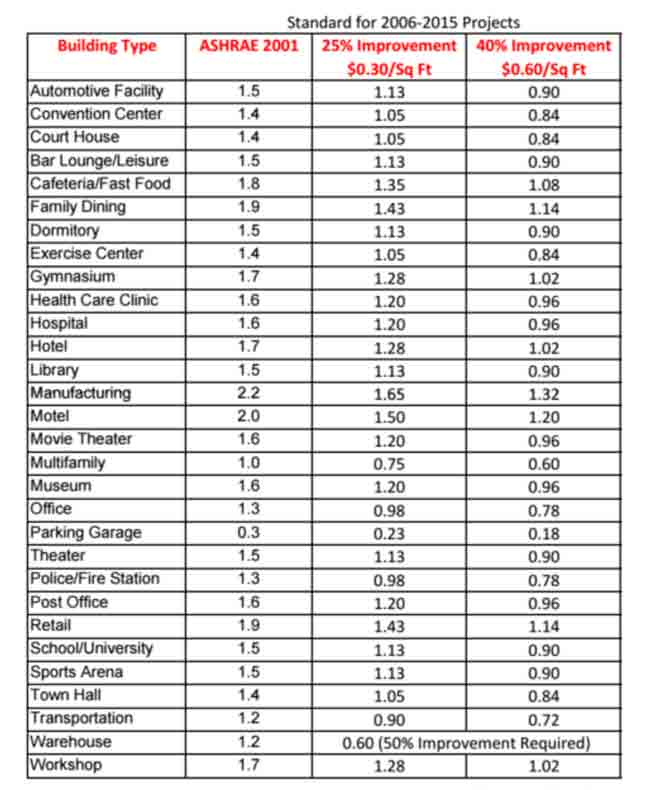

Both existing buildings and new buildings are eligible for the tax incentive. Although virtually all building categories are tax-incentive-eligible, the benefits are particularly favorable for warehouses and manufacturing buildings. To qualify, a building, post-project, must reduce its energy costs as compared to a specific version of the ASHRAE 90.1 energy code standard.

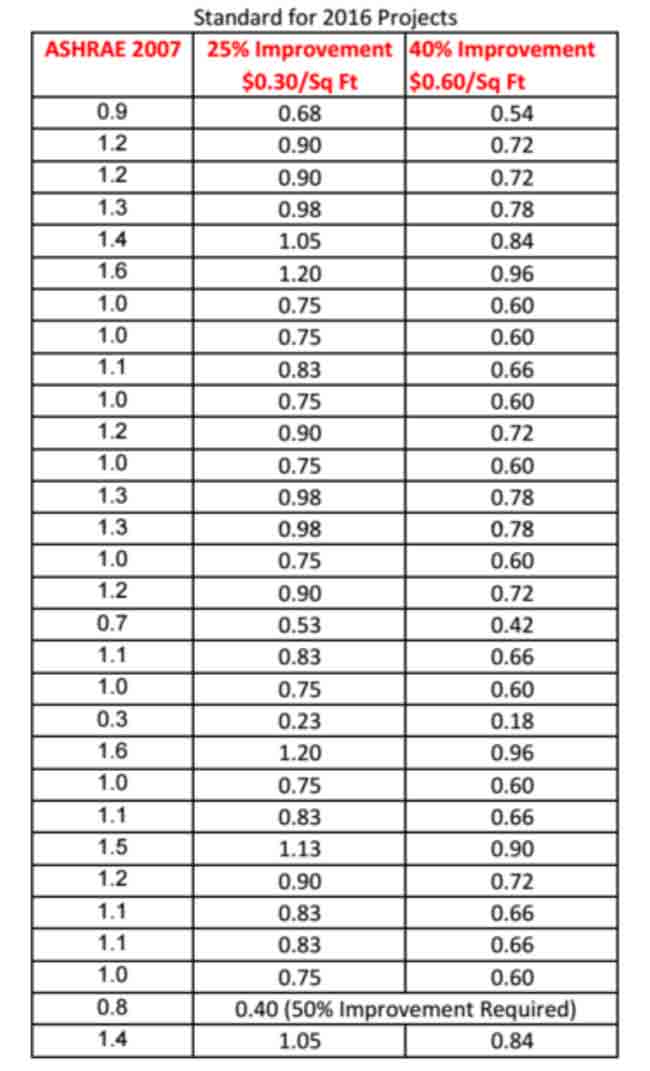

For the tax years 2006 through 2015, the energy code standard that needs to be surpassed by a specified amount is ASHRAE 90.1-2001. For projects completed in 2016 the building energy code that must be surpassed is ASHRAE 90.1-2007. For lighting, ASHRAE 90.1-2007 is on average approximately 25 percent more energy efficient than ASHRAE 90.1-2001. We find that most LED lighting projects can easily meet this threshold. For HVAC, ASHRAE 90.1-2007 is very similar to ASHRAE 90.1-2001.

Obtaining Retroactive EPAct Benefits

Section 179D is a very favored tax incentive being that commercial property owners can go back retroactively and recoup any missed tax incentives and report them on their next filed tax return. This special privilege was provided by IRS in Notice 2011-14.

Action Items for Year 2015 Projects

Property owners who completed lighting, HVAC, or building envelope projects in 2015 should act quickly to get them processed and included in their 2015 tax filings.

For Year 2006 through 2014 projects

For the years 2006 through 2014, building owners with past lighting, HVAC and building envelope projects should consider a retroactive catch up filing for inclusion in their 2015 tax return.

For 2016 Projects

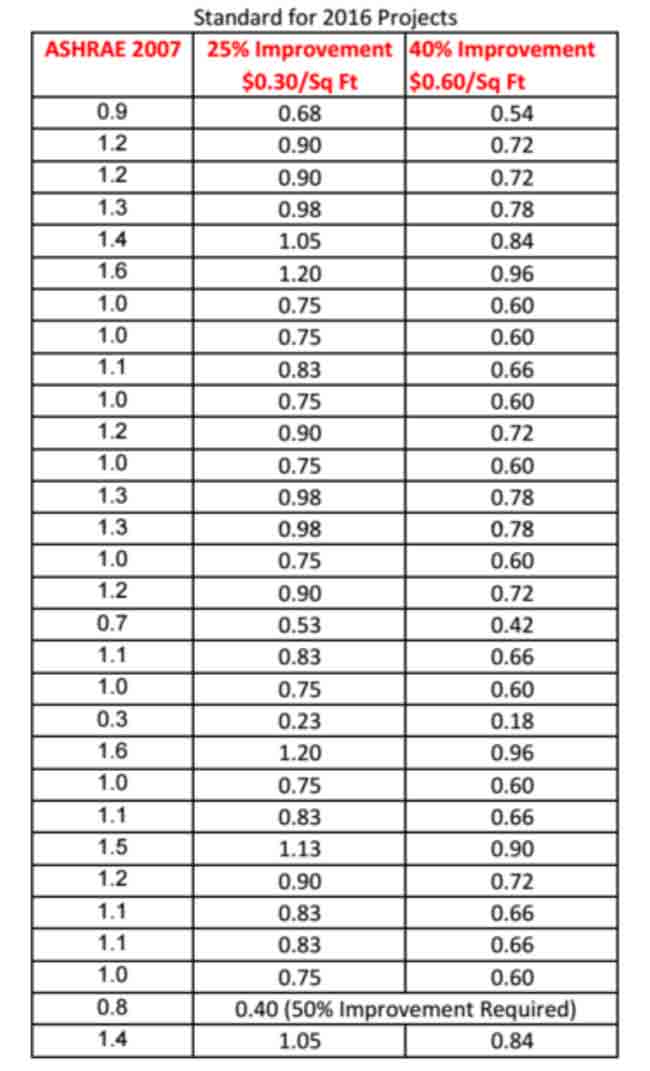

For the year 2016, building owners with lighting, HVAC, and building envelope projects should ask their equipment specifiers whether the project meets the required energy savings as compared to ASHRAE 90.1-2007. The new lighting wattage reduction requirements for the tax incentive are reflected in the table below.

With this two year extension of Section 179D, energy efficient tax incentives have now been available for 11 years. Most existing buildings that are 11 years or older have had some type of upgrade that likely qualifies for tax incentives.

Charles R. Goulding (Charles.Goulding@energytaxsavers.com) an attorney and CPA, is president and founder of Energy Tax Savers, Inc. Jennifer Reardon (Jennifer.Reardon@energytaxsavers.com) is a project coordinator and tax analyst with the firm.

EPAct 179D Lighting Tax Deduction Wattages (source: Energy Tax Savers)

Related Topics: