Business Case for Green Design

Sustainable design is more than good intentions; it's a way of reaching business goals

In the past, one obstacle to sustainable design has been cost. That’s no longer the case, as numerous facilities show: A building designed and built with a sustainable approach does not have to cost more per square foot than what might be called a status quo project. But sustainable design does require the facility executive to create a business case to justify an approach that is very different from the traditional approach. That business case is a key element in the decision making and budgeting process.

Most of the business case can be created around hard, tangible elements — return on investment, cost of capital, hurdle rates, worker productivity, energy costs, and long-term operations and maintenance concerns — but some soft considerations may also be of great importance, depending on a company’s culture, brand strategy and focus on the quality of the work environment. That makes it important to look beyond the traditional project-cost model toward one that will recognize the value of an investment in a green building.

What’s important in developing those models is to focus on how dollars are allocated and to what end results. As in any construction project, there is a finite amount of money to be spent and choices to be made. Those choices must be based on the initial strategic decision to use a sustainable design. That decision, in turn, should be drawn from a solid understanding of the ways in which a sustainable approach can help the organization achieve business success.

The decision to build green then determines how trade-offs are made within the budget, protecting the key elements of the sustainable design from being cut to accommodate other things. And it’s the job of the business case to show how sustainability supports the organization’s mission.

Real Costs and Opportunity Costs

Choices made during the design process affect far more than just construction costs. That means it’s important to go beyond the first-cost budget mindset. A simple formula sums things up: real costs + opportunity costs = building value.

The starting point is to define real costs, the ones that show up in the accounting ledgers. Simply stated, a building’s real cost — more typically referred to as life cycle cost — is not only the amount spent building the facility, but also the ongoing expenses for heating, cooling, lighting, repair and maintenance. According to the National Research Council, 60 to 85 percent of a building’s real costs are related to operations; the initial construction cost is 10 percent or less.

Clearly, the longer an organization owns a building, the more important it is to minimize operating costs. The business case must use the impact of these costs over the life of the building — 30 to 40 years of typical useful life for corporate facilities; 75 years or more for public sector buildings — to determine how much should be invested during construction to reduce operating costs. And those reductions can be significant: The National Wildlife Federation headquarters building uses approximately 40 percent less energy per year than a status quo building would.

With operating costs, the business case should be based on factors that drive the organization’s decision making:

- If the building is owner-occupied, the organization will care about the value added by decreasing operating costs; higher cash flow yields higher value.

- If a tenant is paying energy costs, the longer the occupancy period, the more important the savings.

- The price of energy will affect the payback period with respect to energy savings.

- The interest rate on the money that is invested to achieve operating cost savings is also important.

Without getting deeply involved in appraisal theory and the true impact of cost savings on a building’s residual value, a relatively simple problem can be used to profile a simple payback equation. With information about occupancy time and energy costs, combined with the company’s investment decision criteria, the facility executive can calculate the correct amount to spend today to achieve savings that will come in the future.

Many times, the investment decision criteria are as simple as being willing to spend $100 today if it will save you $25 per year — thus a simple four year payback. Payback periods usually appeal to decision makers if they can see it occurring during their tenure.

Instead of payback periods, other companies may base investment decisions on what is known as a hurdle rate: a required return on capital investments. If a company has a hurdle rate of 11 percent and it spends $100 today, it will want savings of about $130 or more within four years (instead of the previous example of $100). The hurdle rate calculation can be turned around: Calculating the present value of the $25 annual savings, discounted at an 11 percent hurdle rate, shows that the maximum allowable investment is $77.55 if considered over a four-year period.

Understanding Opportunity Costs

As important as they are, real costs are not the only costs to be considered. Also important are opportunity costs. What benefits does the organization miss out on if it chooses not to include sustainable features, and what is the value of these potential benefits? In many cases, opportunity costs hinge on how a building affects employees.

- Healthy indoor environments can increase employee productivity, according to an increasing number of case studies. Because workers are by far the largest expense for most companies (for offices, salaries are 72 times higher than energy costs, and they account for 92 percent of the life cycle cost of a building), this has a tremendous effect on overall costs.

- On average, Americans spend more than 90 percent of their time indoors, according to the U.S. Environmental Protection Agency and the American College of Allergy, Asthma & Immunology. Employees in buildings with healthy interiors have less absenteeism and tend to stay in their jobs longer. One major area of potential concern is asthma attacks, which can be triggered by poor indoor air quality. More than 17 million Americans suffer from asthma, including 4.8 million children; 10 million school days are missed each year because of asthma.

- The new Internationale Nederlanden (ING) Bank headquarters in Amsterdam uses only 10 percent of the energy of the building it replaced, and worker absenteeism has fallen by 15 percent since the move into the new building. The combined energy and absenteeism savings equals $3.4 million per year.

- In another well-known example, The West Bend Mutual Insurance Co. documented a 16 percent productivity gain in the early 1990s following a move into a new 150,000-square-foot green building. Its annual payroll at the time was $13 million; the increased productivity was worth more than $2 million a year. Design strategies included daylighting, individually controlled workstation environments, connectivity to nature and improved lighting. Energy costs were reduced by an estimated 40 percent.

- A healthy indoor environment can reduce the likelihood of lawsuits and insurance claims. In Bloomquist v. Wapello, for example, plaintiffs successfully sued employers and builders on the grounds that inadequate ventilation and pesticide applications made the workplace unsafe.

What is the real value of these employee-related improvements? An indication comes from research conducted by Carnegie Mellon University for the General Services Administration (GSA) in 1999. That research found that costs associated with employees amounted to 78 percent of total operations costs, while costs connected directly to the built environment — rent, operations and maintenance, and office moves — made up only 9 percent. Clearly, any measures that improve worker health, productivity and retention can have a tremendous impact. The question then is how does a sustainable building help to accomplish those goals?

According to a growing number of facility executives, measures as simple as providing more daylight and operable windows can have profound effects. As evidence, they point to the fact that office workers are often dissatisfied with temperature, indoor air quality, acoustics and lighting.

Enhance Asset Value and Profits

A high-performance facility can offer competitive advantage and improve real estate value. What’s more, green, high-performance buildings may sell or lease faster and attract and retain tenants better because they combine superior amenity and comfort with lower occupancy costs and more competitive terms. Energy efficiency buffers operating budgets from potential short- or long-term increases in energy prices.

A recently built incubator lab provided Monsanto with the perfect opportunity to blend two business strategies: recruiting top talent and demonstrating the company’s brand attributes. It achieved these goals with a green building that was attractive to scientists because of its work environment and also efficient to operate, producing savings that fell to the bottom line. The building earned a LEED (Leadership in Energy and Environmental Design) rating from the U.S. Green Building Council. That designation supports the company’s brand, which it wants to represent biosensitive products. Industry experts estimated that the company would have had to spend three times the cost of the building in advertising to match the value of the press coverage the building has received.

The GSA puts heavy emphasis on minimizing operating costs as well as on achieving the socially conscious goal of motivating change through example. With a portfolio of more than 340 million square feet — one of the largest in the nation outside of the REITs — GSA is single-handedly creating markets for sustainable products and facilities. By reducing energy use over the life cycle of its buildings and building systems, GSA is having a substantial positive impact on the environment; at the same time its example has produced an indirect, trickle-down effect on the private sector. In addition, Monsanto employees and GSA tenants are benefiting from the improved working environments. Both organizations are benefiting from the full spectrum of advantages offered by sustainable design.

The priorities of every organization are different. Facility executives must take a close look at their companies, then construct business cases to reflect the organization’s main drivers for competitive advantage and success.

Steven Morton is senior vice president and director of HOK Consulting.

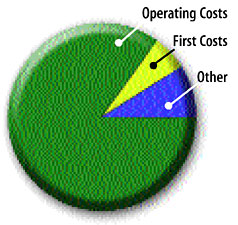

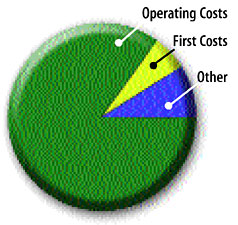

A Building’s Real Cost

A Building’s Real Cost

Operating expenses — things like lighting, cooling and maintenance — make up the largest cost of owning a building. First costs typically account for less than 10 percent of the money that must be spent on a facility over its life; as much as 85 percent of the building’s real cost is related to operating the facility. Other costs include land acquisition, conceptual planning, renewal or revitalization, and disposal.

Source: National Research Council, 1998

Big Picture:

Big Picture:

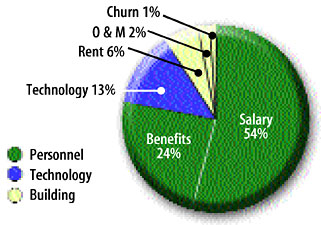

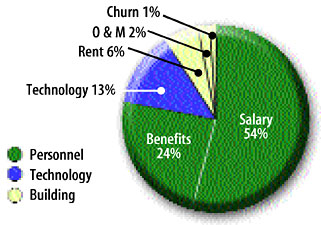

Personnel and building costs

Personnel costs — salary and benefits — make up 78 percent of total business expenses for tenants, according to a study conducted for the General Services Administration, while costs associated with the building itself account for only 9 percent. If a sustainable design can help improve worker health, productivity or retention, the payoff is far greater than any reduction in building life cycle costs.

Source: Carnegie-Mellon University

A CFO’s View of Building Investments

It’s important for facility executives to understand the net present value (NPV) formula used to determine whether an investment is appropriate. This example uses a simple approach to NPV: It looks only at the concept of incremental investment for the purposes of energy savings. It doesn’t factor in the likely inflation of energy costs or any residual value for the investment. (Residual value includes additional savings over the component’s useful life and the impact it has on the future value of the building.)

In the NPV formula shown in Figure 1, CF zero is the initial cash flow or investment. Each fraction that follows is the year-end cost savings divided by 1 plus the hurdle rate, to the power of the year.

Figure 2 shows the math: Assume that a $100 investment produces annual savings of $25 over four years. In the NPV calculation, a negative $100 is used because $100 was the amount initially invested. The net present value of each of the subsequent year-end savings is $25, which translates into a net present value of negative $22.45; that means the investment fails to meet the company’s 11 percent hurdle rate. Had the NPV been positive, the savings over the period would have yielded a return greater than 11 percent. Had the NPV been zero, then the decision would have been neutral because savings would have equalled the theoretical alternative investment for the company’s funds.

Related Topics:

A Building’s Real Cost

A Building’s Real Cost Big Picture:

Big Picture: